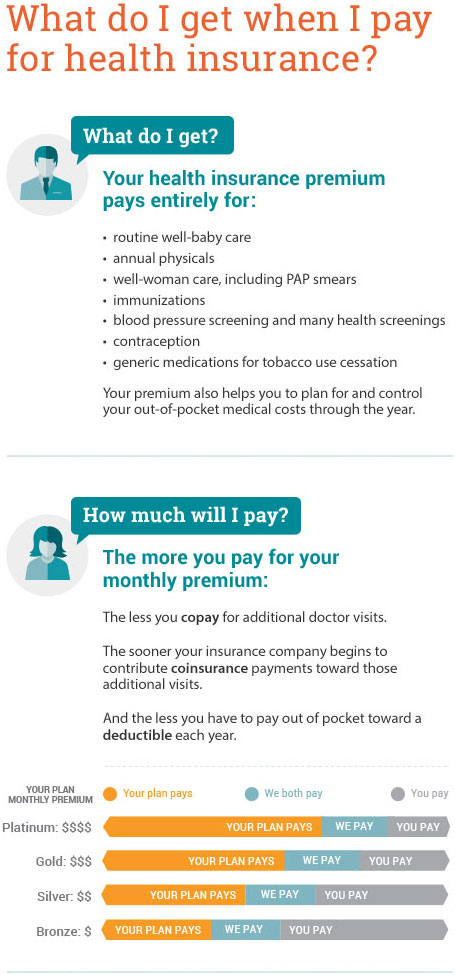

To save money on your health care, you should first make sure you understand what you'll have to have to pay for.

The things you'll pay for include:

- Your monthly health insurance plan premium

- Your copay to see a doctor

- Your insurance deductible on services, treatments and visits

- Your coinsurance on services, treatments and visits after you've met your insurance deductible

Payment for services or products that are not covered in your plan

How much all of those things cost depends on which level of plan you choose.

- When you go to see a health care provider, you pay your copay at the time of your appointment.

- That health care provider sends a bill to us, detailing the services you received.

- We reconcile the doctor's bill against your plan's coverage. We pay your plan's share, if any, to the provider.

- We then send you the explanation of benefits in a statement, known as an EOB. It tells you that we received the medical bill, explains how we applied your health plan coverage toward a portion of the bill, and tells you what you'll have left to pay to the provider.

Finally, the doctor's office sends you the bill with whatever balance was not covered by your health insurance plan.

Cost-saving tip: It's a good idea to compare your explanation of benefits with your final medical bill to make sure there are no errors.

Health insurance plans purchased on the marketplace provide a ceiling on how much money you'll spend on your health care costs in a year. This is called an out-of-pocket maximum. Medical bills that contribute to your out-of-pocket maximum include your:

- Deductible

- Coinsurance

Copays for all medical and drug expenses

The following medical bills do not count toward your out-of-pocket maximum:

- Premiums

- Bills for out-of-network providers

Spending for services not covered by your plan

In 2016, the out-of-pocket maximum amount allowed for individuals was $6,850. For families, it was $13,700.

We understand how important it is to be able to know what your medical bills will be in any given month or year—and even any given appointment. That's why we offer our members a health care cost calculator. Learn more.